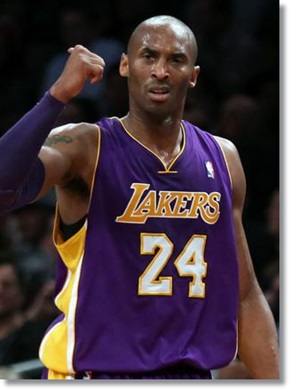

It’s been a long and arduous rehab for future NBA Hall of Famer Kobe Bryant from a torn Achilles tendon suffered late last season.

It’s been a long and arduous rehab for future NBA Hall of Famer Kobe Bryant from a torn Achilles tendon suffered late last season.

In addition to the almost never done before comeback from such a serious injury at the advanced age of 35, Bryant doesn’t have much talent left on the Lakers roster when he does finally return as 7 time NBA All Star Dwight Howard has decided to defect to the Houston Rockets after just one season.

But one thing that Bryant has that seemingly cures everything is money and he has lots of it. In fact, Kobe is the NBA’s highest paid player this season by a wide margin, making upwards of $30 million this season.

It is estimated that Bryant has made more than $280 million in salary alone during his 18 year career, plus endorsements.

A huge chunk of that mountain of money was given to Bryant on Friday as he was paid a $24.3 million advance on his salary, the highest allowed balloon payment per the Collective Bargaining Agreement, which is 80% of a player’s yearl salary.

Now that’s an amazing amount of cash for anyone, but any savvy businessman knows that Kobe won’t immediately get his hands on the rather large lump sum, at least until Uncle Sam takes his share.

In a staggering revelation, the state of California and federal government is entitled to roughly $13 million of the balloon payment, making Kobe’s haul a rather miniscule $11 million, plus a little more than $6 million over the remainder of the regular season.

Here’s the total breakdown per ESPN:

Bryant’s total take home of the $24.3 million check is subject to heavy taxes, which could total as much as 55 percent of his salary. That would reduce his take-home pay to closer to $11 million, according to Robert Raiola, a certified public accountant who heads up the sports and entertainment group at FMRTL in Cranford, N.J.

In his tax bracket, Bryant is subject to paying a federal tax at the top rate of 39.6 percent, which would mean $9.6 million will be withheld by Uncle Sam. As a California resident, he’s subject to paying an additional 13.3 percent, or $3.2 million, in state taxes. California has the highest state income tax in the United States. The Medicare tax and surcharge would reduce his total take to about $10.9 million.

Kobe’s $30.5 million salary this season is the 2nd highest all time, behind only Michael Jordan’s $33.1 million record haul back in ’97-’98. I wonder how the “Mamba” will survive?….

Allen Moll has been a lifelong NBA and NCAA College Basketball fan who watches and studies games religiously, and coaches youth basketball in his native Lehigh Valley region of Pennsylvania. Allen has also provided content to Bleacherreport.com, Upperdeckblog.com, Cleveland.com, CSN Philly.com, Buckets Magazine, in addition to being a tenured NBA and NCAA columnist for TheHoopDoctors.com.